$15/Hour: Essential Income Facts

⚠️ Reality check: $23,400-$25,440 annually after taxes (many need assistance or supplemental income)

At $15 per hour—what many consider the minimum living wage threshold—every dollar counts. While this rate has become a rallying cry for fair pay advocates nationwide, the financial reality varies dramatically by location. Understanding exactly what this translates to across different time periods helps you navigate tough budgeting decisions, evaluate assistance programs, and plan income growth strategies. Whether you’re comparing this to $16/hour, $17/hour, or $18/hour, each dollar-per-hour increase creates meaningful breathing room in your budget.

$15 an hour is how much a year?

At $15 per hour working full-time, your annual salary is $31,200.

The standard calculation uses 2,080 working hours per year (40 hours per week × 52 weeks).

So, $15 × 2,080 hours = $31,200 per year before taxes.

How much is $15 an hour per month?

Working full-time at $15/hour gives you a monthly income of approximately $2,600.

You can calculate this two ways: divide annual salary by 12 months ($31,200 ÷ 12), or multiply weekly pay by average weeks per month ($600 × 4.33).

Both methods yield roughly $2,600 per month before taxes, which is the key number for budgeting rent, utilities, and monthly expenses.

How much is $15 an hour bi-weekly?

For bi-weekly pay periods, earning $15/hour results in $1,200 per paycheck.

This calculation is simple: 40 hours per week × 2 weeks = 80 hours, then 80 hours × $15 = $1,200 bi-weekly.

Bi-weekly pay is one of the most common payroll systems in the USA, with 26 pay periods annually.

How much is $15 an hour weekly?

Working 40 hours per week at $15/hour gives you $600 weekly.

Simply multiply your hourly wage by weekly hours: $15 × 40 = $600 per week before taxes.

If you work overtime hours at time-and-a-half ($22.50/hour), your weekly earnings can increase substantially.

$15 an hour is how much a day?

Based on a standard 8-hour workday, your daily income at $15/hour is $120.

The calculation: $15 × 8 hours = $120 per day before taxes.

For longer shifts like 10 or 12 hours, your daily earnings scale accordingly to $150 or $180 respectively.

Complete Income Breakdown for $15/Hour

| Pay Period | Gross Income | Est. After-Tax* |

|---|---|---|

| Hourly | $15.00 | $11.25 – $12.22 |

| Daily (8 hrs) | $120 | $90 – $98 |

| Weekly | $600 | $450 – $489 |

| Bi-Weekly | $1,200 | $900 – $978 |

| Monthly | $2,600 | $1,950 – $2,120 |

| Annually | $31,200 | $23,400 – $25,440 |

*After-tax assumes 25-30% withholding. Low earners may qualify for EITC and receive refunds.

The Reality of Living on $15/Hour

Economic Context

At $31,200 annually, you’re earning just 44% of the U.S. median household income. This places you below the poverty line for families of four ($31,200 threshold in 2026) and requires careful financial management even for single individuals.

The difference between $15/hour and $18/hour is $6,240 annually—that’s $520 more monthly, which can be the difference between financial stress and stability.

⚠️ Challenging Realities

- Rent typically exceeds 50% of income in many areas

- Emergency expenses create immediate crisis

- Healthcare costs often unaffordable

- Savings nearly impossible without assistance

- Transportation costs strain budget significantly

✓ Where It Can Work

- Low-cost rural areas with cheap housing

- Shared living arrangements with roommates

- Access to public assistance programs

- No dependents or major debt obligations

- Employer-provided benefits (health insurance)

Realistic Survival Budget on $15/Hour

Monthly after-tax income: approximately $2,035 (mid-range state)

⚠️ Critical Challenge

At $15/hour, the 50/30/20 rule doesn’t work. Instead, most of your income goes to survival needs, leaving minimal room for wants or savings.

Essential Monthly Expenses (~85% = $1,730)

Escaping the $15/Hour Trap: Growth Pathways

🎯 Immediate Actions

- Pick up every overtime hour available ($22.50/hr)

- 5 OT hours weekly = $5,850 extra annually

- Request all available shifts

- Apply for EITC and other tax credits

📚 6-12 Month Plan

- Free community college courses

- Online certifications (Google, HubSpot)

- Trade apprenticeships (paid training)

- Target: $18-$20/hour positions

🚀 Job Switching Strategy

- Apply to higher-paying similar roles

- Target companies with better benefits

- Negotiate aggressively ($17-$19 range)

- $3/hr increase = $6,240 more annually

Essential Assistance Programs for $15/Hour Workers

At this income level, you likely qualify for multiple support programs:

Typical $15/Hour Jobs

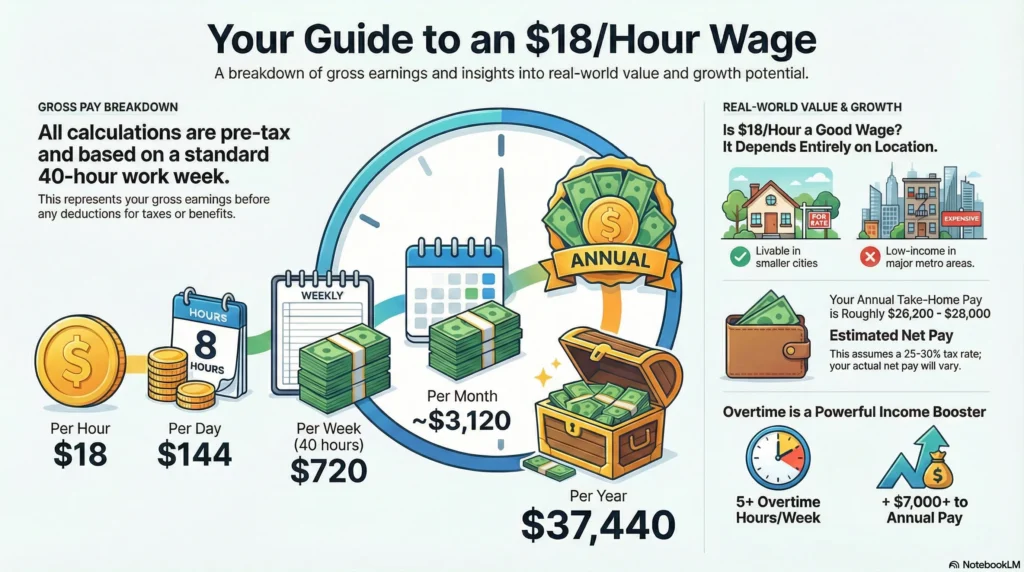

Compare Wage Increases

See how each dollar increase impacts annual income:

Frequently Asked Questions

$15 an hour is how much a year?

$15 an hour equals $31,200 per year before taxes, based on standard full-time employment (2,080 hours annually). After taxes, expect $23,400-$25,440 depending on your state and filing status.

Can you live on $15 an hour?

It’s extremely challenging. At $31,200 annually, you’re below the poverty line for a family of four. Survival is possible for single individuals in low-cost areas with shared housing, but requires accessing assistance programs, strict budgeting, and typically no emergency savings buffer.

How much is $15 an hour monthly after taxes?

Monthly take-home pay ranges from $1,950 to $2,120 after standard deductions. This means rent should ideally stay under $585-$636 (30% of income), which is unrealistic in most markets without roommates or subsidized housing.

Is $15 an hour considered minimum wage?

It’s above the federal minimum wage ($7.25/hour) but has become the de facto “living wage” target in many states. However, studies show true living wages vary from $17-$25/hour depending on location, making $15/hour insufficient in many markets.

What government assistance qualifies at $15/hour?

At $31,200 annually, you likely qualify for SNAP (food stamps), Medicaid, EITC tax credits, and housing assistance in most states, especially with dependents. These programs are essential for financial stability at this income level and you should apply without hesitation.

Hey there! I’m Kumar, the owner of DollarHire. Alongside working as an Executive SEO Specialist, I studied at a finance institute to strengthen my skills in finance and marketing.

Pingback: $14 an Hour Is How Much a Year, Month & Daily?

Pingback: $12 an Hour Is How Much a Week, Month & Year? (Before & After Tax)

Pingback: $13 an Hour Is How Much a Year? (Net vs Gross Pay Calculator)