21.50 an Hour Breakdown

💰 After-tax estimate: $32,600-$34,900 annually (based on 25-30% tax rate)

At 21.50 per hour, you’re earning above the U.S. median hourly wage but below six-figure territory—a sweet spot where financial stability becomes achievable with smart planning. Whether you’re evaluating a new job offer or planning your budget around this rate, understanding the true value across different time periods reveals opportunities you might be missing. Let’s break down exactly what this hourly wage means for your financial life, and compare it to similar rates like $21/hour or $22/hour to understand your earning position.

21.50 an hour is how much a year?

At 21.50 per hour working full-time, your annual salary totals $44,720.

The standard calculation multiplies your hourly rate by 2,080 working hours annually (40 hours per week × 52 weeks).

Therefore, 21.50 × 2,080 hours = $44,720 per year before taxes.

How much is 21.50 an hour per month?

Working full-time at 21.50/hour provides a monthly income of approximately $3,726.67.

You can calculate this two ways: divide annual salary by 12 months ($44,720 ÷ 12), or multiply weekly pay by average weeks per month ($860 × 4.33).

Both methods yield roughly $3,727 per month before taxes, which is the critical number for budgeting rent, utilities, and monthly expenses.

How much is 21.50 an hour bi-weekly?

For bi-weekly pay periods, earning 21.50/hour results in $1,720 per paycheck.

This calculation is straightforward: 40 hours per week × 2 weeks = 80 hours, then 80 hours × 21.50 = $1,720 bi-weekly.

Bi-weekly pay is one of the most common payroll systems in the USA, with 26 pay periods annually.

How much is 21.50 an hour weekly?

Working 40 hours per week at 21.50/hour gives you $860 weekly.

Simply multiply your hourly wage by weekly hours: 21.50 × 40 = $860 per week before taxes.

If you work overtime hours at time-and-a-half ($32.25/hour), your weekly earnings can increase substantially.

21.50 an hour is how much a day?

Based on a standard 8-hour workday, your daily income at 21.50/hour is $172.

The calculation: 21.50 × 8 hours = $172 per day before taxes.

For longer shifts like 10 or 12 hours, your daily earnings scale accordingly to $215 or $258 respectively.

Complete Income Breakdown for 21.50/Hour

| Pay Period | Gross Income | Est. After-Tax* |

|---|---|---|

| Hourly | 21.50 | $16.13 – $17.20 |

| Daily (8 hrs) | $172 | $129 – $138 |

| Weekly (40 hrs) | $860 | $645 – $688 |

| Bi-Weekly | $1,720 | $1,290 – $1,376 |

| Monthly | $3,726.67 | $2,795 – $2,983 |

| Annually | $44,720 | $33,540 – $35,776 |

*After-tax estimates based on 25-30% effective tax rate. Actual take-home varies by state, deductions, and filing status.

State-by-State Take-Home Pay at 21.50/Hour

Geographic location creates a $2,000-$4,000 annual swing in actual take-home pay. Here’s what $44,720 gross becomes after state taxes:

💡 Financial Impact: Moving from Oregon to Texas at this wage level puts an extra $294/month in your pocket—enough to cover a car payment or significantly boost retirement savings.

Real-World Livability: Where 21.50/Hour Works Best

Economic Position Context

At $44,720 annually, you’re earning roughly 63% of the U.S. median household income ($70,784 in 2024). This positions you above survival-wage territory but requires location-conscious decisions for comfortable living.

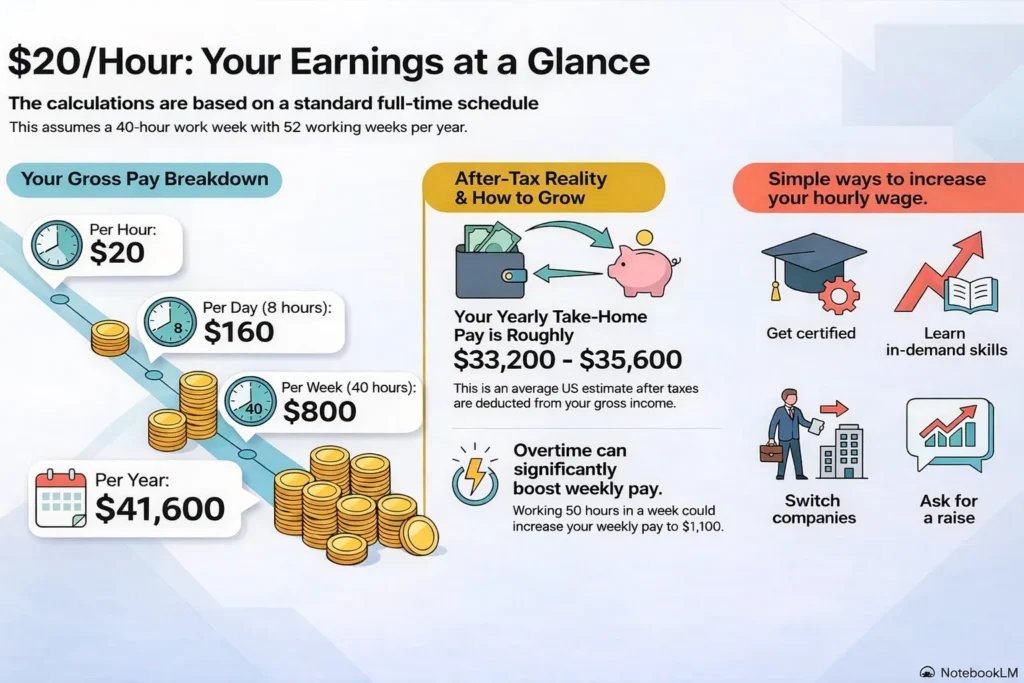

Compared to $20/hour ($41,600/year), you’re earning $3,120 more annually—that’s $260/month in additional breathing room.

Markets Where 21.50/Hour Provides Solid Living

🏘️ Comfortable Living Zones

- Small cities in Midwest and South

- Suburban areas outside top-20 metros

- College towns with diverse housing

- Most of Texas, Ohio, Tennessee, Iowa

⚠️ Tight Budget Territories

- San Francisco Bay Area, Manhattan

- Boston, Seattle, Los Angeles proper

- Boulder, Austin downtown areas

- Any coastal metro with median rents >$1,800

Practical Monthly Budget on 21.50/Hour

Using after-tax monthly income of approximately $2,880 (mid-range state), here’s a realistic 50/30/20 budget allocation:

Essential Needs (50% = $1,440)

Lifestyle Wants (30% = $864)

Financial Goals (20% = $576)

Career Trajectory: Moving Beyond $21.50/Hour

💡 Professional Reality Check

At 21.50/hour, you’re typically 2-4 years into a career or in a skilled intermediate role. This wage rarely represents a final destination—most professionals at this level advance to $25-$32/hour within 3-5 years through three primary pathways:

📚 Skill Stacking

Adding certifications or specialized skills typically adds $2-$5/hour:

- Healthcare: CNA → LPN certification

- IT: Help Desk → CompTIA Network+

- Manufacturing: Operator → Quality Inspector

- Admin: Coordinator → Project Management cert

🎯 Strategic Job Switching

External moves average 10-20% raises vs. 3-5% internal:

- $21.50 → $24/hour = $5,200 annual bump

- Timing: 18-24 months in current role optimal

- Target: Competitors or larger organizations

- Leverage: Multiple offers for negotiation

⏰ Overtime Optimization

Time-and-a-half ($32.25/hour) adds significant income:

- 5 OT hours weekly = $8,385 extra annually

- 10 OT hours weekly = $16,770 extra annually

- Weekend differential often adds 15-20% more

- Holiday pay: Double or triple time

Common Careers at 21.50/Hour

This wage level typically encompasses intermediate-skilled roles across diverse industries:

Compare Nearby Hourly Rates

Understanding marginal wage differences helps evaluate raises and counteroffers:

Frequently Asked Questions

How much is 21.50 an hour per year?

21.50 an hour equals $44,720 per year before taxes, based on 2,080 annual work hours (40 hours/week × 52 weeks).

How much is 21.50 an hour per month after taxes?

After-tax monthly income ranges from approximately $2,795 to $2,983, depending on your state tax rate and deductions. States without income tax (Texas, Florida, Washington) provide the highest take-home amounts at roughly $3,015 monthly.

Is 21.50 an hour considered middle class?

At $44,720 annually, you’re in the lower-middle class bracket for single earners. This classification improves significantly with a working spouse or in lower cost-of-living areas. In expensive markets like San Francisco or Manhattan, it’s considered working class.

Can you live alone on $21.50 an hour?

Yes, in most mid-to-low cost areas. Budget $850-$1,000 monthly for housing (ideally under 30% of gross income). Major cities like NYC, LA, or San Francisco typically require roommates or living in outer boroughs/suburbs. Mid-size cities in the South, Midwest, and parts of the Southwest support solo living at this wage.

What’s the difference between $21.50/hour and $25/hour?

A $3.50/hour increase from $21.50 to $25 represents a $7,280 annual raise ($607/month gross). After taxes, expect roughly $455-$485 extra monthly—enough to significantly improve quality of life, accelerate debt payoff, or boost retirement contributions from minimal to meaningful levels.

Hey there! I’m Kumar, the owner of DollarHire. Alongside working as an Executive SEO Specialist, I studied at a finance institute to strengthen my skills in finance and marketing.