22 an Hour Is How Much a Year?

If you make 22 an hour working full-time (40 hours per week), you’ll earn $45,760 per year before taxes.

That breaks down to $3,813 monthly, $1,760 bi-weekly, or $880 weekly. After federal and state taxes, expect to take home approximately $35,000-$37,000 annually, depending on your location and filing status.

Quick math: $22/hour × 40 hours/week × 52 weeks/year = $45,760 gross annual salary

You’re looking at a job offer that pays $22 an hour, or maybe you’re already earning that rate and wondering if it’s enough to live comfortably in 2026. Let’s break down exactly what 22 an hour is how much a year translates to in real terms — not just the gross number, but what actually lands in your bank account and whether it’s enough to cover rent, bills, and maybe even save a little.

The short answer? 22 an hour is how much a year depends on whether you’re working full-time, part-time, or with overtime. For a standard full-time schedule, you’re looking at $45,760 before taxes. But here’s what most salary calculators won’t tell you: location matters massively. Someone making $22 an hour in rural Ohio has completely different purchasing power than someone earning the same rate in San Francisco.

The Complete Breakdown: 22 an Hour Is How Much a Year

Full-Time (40 Hours Per Week)

This is the standard calculation most people want when asking “22 an hour is how much a year.” Working 40 hours per week for 52 weeks gives you 2,080 working hours annually.

Calculation: $22/hour × 40 hours/week × 52 weeks/year = $45,760 per year

Breaking It Down Further

When you’re budgeting or comparing job offers, it helps to know what 22 an hour is how much a year looks like in different time periods:

What If You’re Not Working Full-Time?

Part-Time (30 Hours Per Week)

If you’re working 30 hours weekly at $22 per hour, calculating 22 an hour is how much a year becomes:

With Overtime (50 Hours Per Week)

Many hourly jobs offer overtime at time-and-a-half (1.5×) for hours beyond 40. If you regularly work 50 hours per week:

That’s an extra $17,160 per year with consistent 10-hour overtime weeks — a 37% salary boost.

22 an Hour Is How Much a Year After Taxes?

The $45,760 gross salary sounds decent, but let’s talk about what actually hits your bank account. When calculating 22 an hour is how much a year after taxes, you need to account for federal income tax, Social Security, Medicare, and potentially state/local taxes.

Federal Tax Breakdown (Single Filer, 2026)

According to the IRS 2026 tax tables, here’s what gets deducted from your $45,760 gross:

Reality check: That’s about $3,095/month or $1,428 bi-weekly actually deposited. Your 22 an hour is how much a year take-home depends heavily on your state — Texas and Florida residents keep more (no state income tax), while California and New York residents see bigger deductions.

Can You Live on $22 an Hour in 2026?

This is the real question behind “22 an hour is how much a year” — not just the math, but whether it’s livable. The answer: it depends entirely on where you live and your lifestyle.

Where $22/Hr Works

Lower cost-of-living areas like:

- Midwest cities (Indianapolis, Cincinnati, Kansas City)

- Southern states (parts of Texas, Tennessee, Georgia)

- Small towns and rural areas

$37K take-home can cover rent, utilities, groceries, car payment, and modest savings.

Where It’s Tight

High-cost urban centers:

- San Francisco, NYC, Seattle, Boston

- Los Angeles, San Diego, Denver

- Any city where 1-bed apt > $1,500/mo

You’d need roommates or a second income. Rent alone could eat 50%+ of take-home.

Sample Monthly Budget at $22/Hour

Based on $3,095 monthly take-home (after taxes):

This assumes moderate spending and no major debt. If rent is higher in your area, savings disappear quickly — which is why understanding “22 an hour is how much a year” in your specific market is crucial.

How Does $22 an Hour Compare?

To put “22 an hour is how much a year” in perspective, here’s how it stacks up against other common hourly rates and the national average:

| Hourly Rate | Annual Salary | Monthly (After Tax) |

|---|---|---|

| $15/hour (min wage many states) | $31,200 | ~$2,200 |

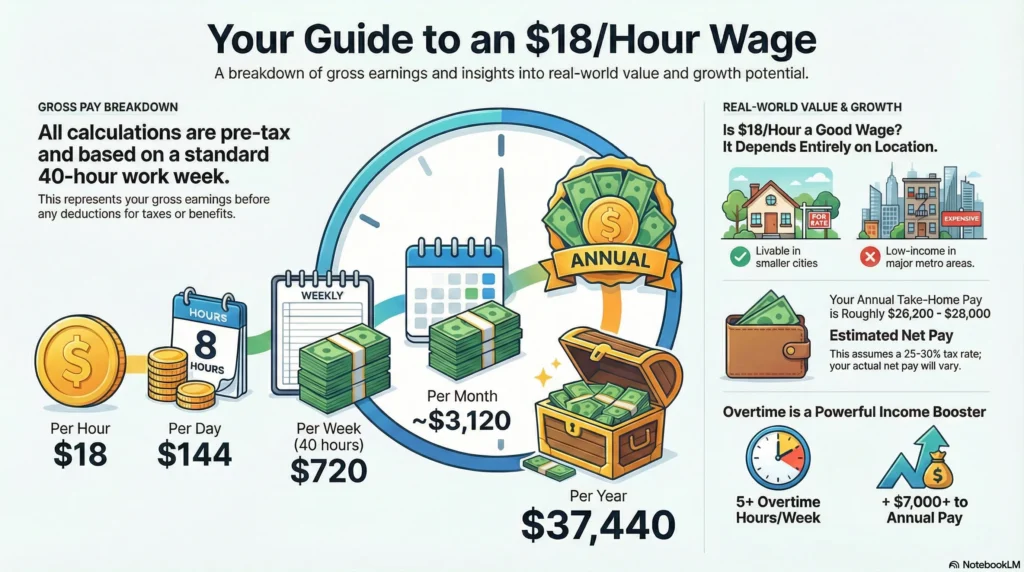

| $18/hour | $37,440 | ~$2,650 |

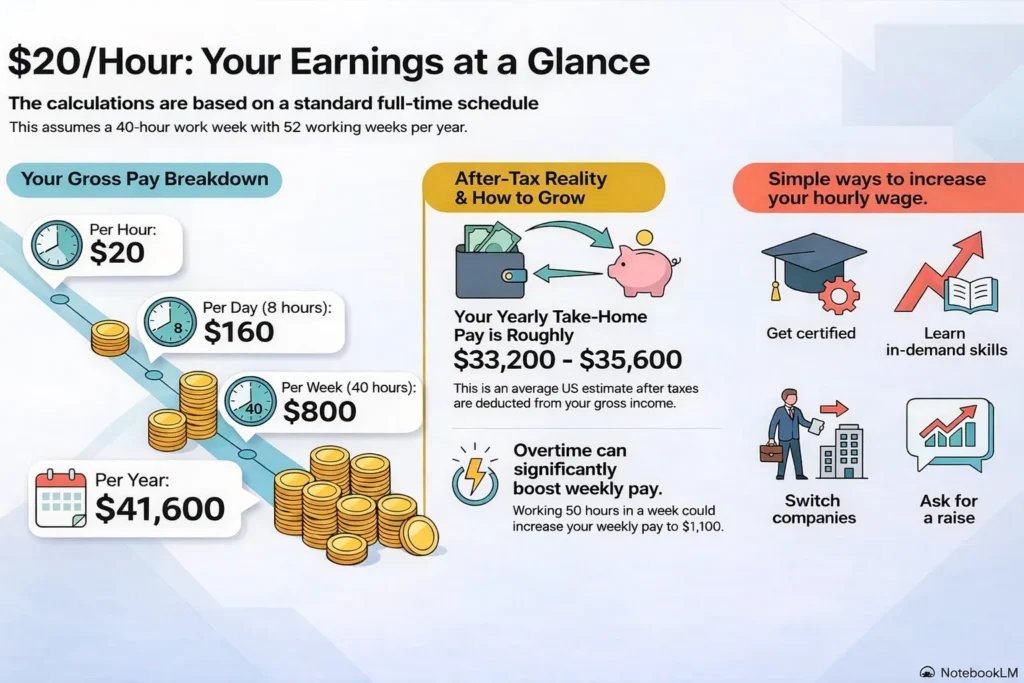

| $20/hour (median U.S. 2026) | $41,600 | ~$2,900 |

| $22/hour | $45,760 | ~$3,095 |

| $25/hour | $52,000 | ~$3,500 |

| $30/hour | $62,400 | ~$4,100 |

At $22 an hour, you’re earning 10% above the national median wage — not rich, but solidly middle-class in most markets. To put it another way: 22 an hour is how much a year translates to more than what 52% of American workers earn, according to wage data.

Frequently Asked Questions

How much is $22 an hour monthly?

Working full-time at $22 an hour gives you $3,813 per month before taxes, or approximately $3,095 after taxes (assuming average tax rates for a single filer). This calculation assumes 173.33 hours per month (2,080 annual hours ÷ 12 months).

Is $22 an hour good pay in 2026?

It depends on your location and situation. At $45,760 annually, you’re earning above the national median wage ($41,600 for $20/hour). In lower cost-of-living areas, $22 an hour can support a comfortable single-person lifestyle. In expensive cities like SF or NYC, you’d likely need roommates or a second income. For context, 22 an hour is how much a year places you in the 52nd percentile of U.S. wage earners.

How much is $22 an hour bi-weekly?

Your bi-weekly paycheck at $22 an hour (80 hours) is $1,760 before taxes, or approximately $1,428 after taxes. Most employers pay bi-weekly (26 paychecks per year), making this the most common paycheck amount you’ll see when earning $22 hourly.

Can I afford a house on $22 an hour?

With $45,760 annual income, most lenders will approve you for a home around $140,000-$160,000 (following the 3x income rule). Your monthly mortgage payment shouldn’t exceed $1,145 (30% of $3,813 gross monthly). In many Midwest and Southern markets, this can buy a starter home. In coastal cities, you’d need a higher income or dual-income household. When asking “22 an hour is how much a year for homebuying,” remember to factor in property taxes, insurance, and maintenance costs too.

What jobs pay $22 an hour?

Common jobs that pay around $22/hour include: dental assistants, pharmacy technicians, licensed practical nurses (LPNs), administrative assistants with experience, customer service supervisors, entry-level software support, warehouse supervisors, delivery drivers at major companies, paralegal assistants, and skilled trades apprentices. When comparing job offers and calculating 22 an hour is how much a year, also consider benefits like health insurance, 401k matching, and paid time off — these can add $5,000-$15,000 in annual value.

How much is $22 an hour with 2 weeks vacation?

If your employer offers 2 weeks (80 hours) of paid vacation, you’re still earning the full $45,760 annually — the vacation time is paid. However, if it’s unpaid time off, you’d work 50 weeks instead of 52, making your annual income $44,000 ($22 × 40 hours × 50 weeks). Always clarify whether vacation is paid when evaluating job offers and calculating your true annual earnings.

The Bottom Line on $22 an Hour

When someone asks “22 an hour is how much a year,” the math is straightforward: $45,760 annually before taxes, or about $37,000 take-home after federal, state, and payroll taxes.

Whether that’s “good” depends entirely on where you live and your financial goals. In lower cost-of-living areas, $22 an hour provides a solid middle-class lifestyle with room to save. In expensive metros, it covers basics but leaves little margin for error. The key is understanding your specific market and building a budget around your actual take-home pay, not the gross number. And if you can snag consistent overtime? That time-and-a-half rate can boost your annual earnings by $10K-$17K, making a significant difference in your financial stability.

Compare Similar Hourly Wages

Last Updated: February 2026 | All salary calculations assume a standard 40-hour work week for 52 weeks (2,080 annual hours). Tax estimates are based on 2026 IRS federal tax brackets for single filers with standard deduction, plus average state tax rates. Your actual take-home pay will vary based on your specific tax situation, state of residence, and any pre-tax deductions (401k, HSA, etc.). Use this guide as a starting point, but consult a tax professional for personalized advice.

Hey there! I’m Kumar, the owner of DollarHire. Alongside working as an Executive SEO Specialist, I studied at a finance institute to strengthen my skills in finance and marketing.

Pingback: $23 an Hour Is How Much a Year? (Income Calculator)

Pingback: $25 an Hour Is How Much a Year? (Before & After Taxes)

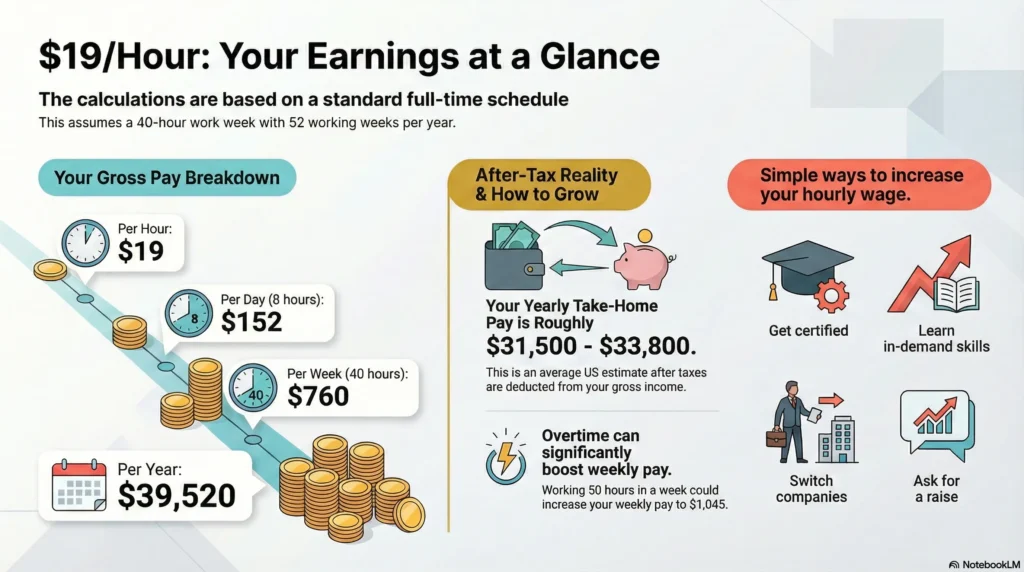

Pingback: $19 an Hour Is How Much a Year? (Day, Week, Month & Gross Pay Calculator)

Pingback: $20 an Hour Is How Much a Year, Month, Week & Day? 2025

Pingback: $21.50 an Hour Is How Much a Year? 2025/2026

Pingback: $24 an Hour Is How Much a Year? (Net vs Gross Pay)

Pingback: 21 an Hour Is How Much a Year? This Will Shock You! 😱

Pingback: What Is The Average Salary in Mexico – 2026 (UPDATED) ✅