Earning $94 an hour puts you in a rare income category in the United States. This pay rate translates into a powerful six-figure salary and opens the door to financial stability, asset building, and premium living. But how much does it actually add up to over a year, and what do you really take home after taxes? Let’s break it down clearly.

Hourly Wage Calculator

Before-Tax Salary Summary at $94/Hour

| Pay Period | Earnings |

|---|---|

| Daily | $752 |

| Weekly | $3,760 |

| Biweekly | $7,520 |

| Monthly | ~$16,293 |

| Yearly | $195,520 |

Estimated After-Tax Take-Home Pay at $94 an Hour

Assuming a combined 30%–34% total tax rate (federal, state, and FICA)

| Pay Period | Estimated Take-Home |

|---|---|

| Daily | ~$496 – $526 |

| Weekly | ~$2,482 – $2,632 |

| Biweekly | ~$4,963 – $5,264 |

| Monthly | ~$10,753 – $11,405 |

| Yearly | ~$129,000 – $136,800 |

More Hourly Calculator:

> $93 an Hour Is How Much a Year, Daily, Weekly, Monthly -2025

> $92 an Hour Is How Much a Year, Daily, Weekly, Monthly -2025

> $91 an Hour Is How Much a Year, Daily, Weekly, Monthly -2025

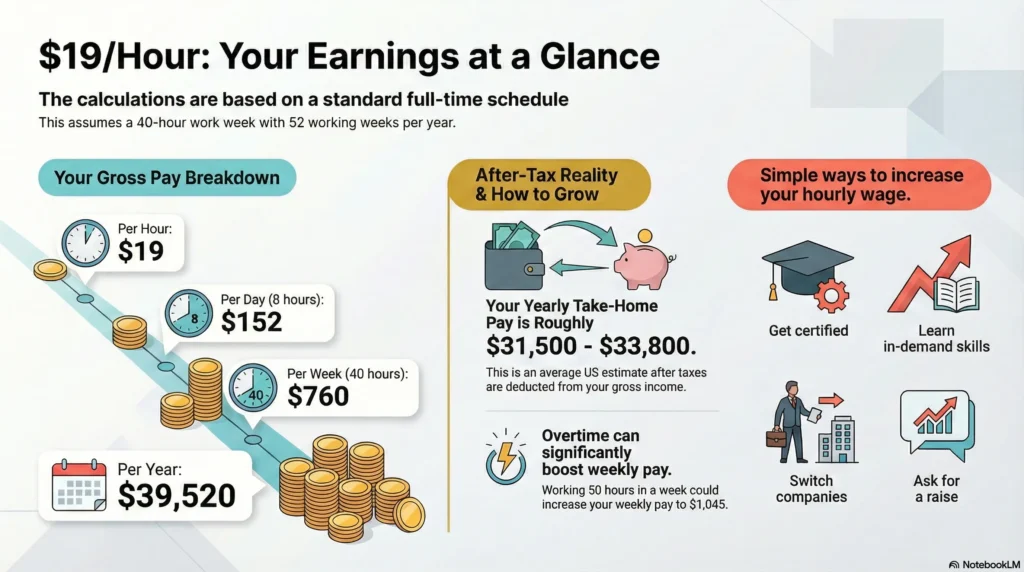

Daily Income at $94 an Hour

For most full-time professionals working an 8-hour day, daily earnings at $94/hour are very strong. A standard shift results in $752 per day before taxes. If your schedule extends to 10 hours, your daily income increases to $940 per day. Even limited overtime can significantly raise weekly pay due to the high base hourly rate.

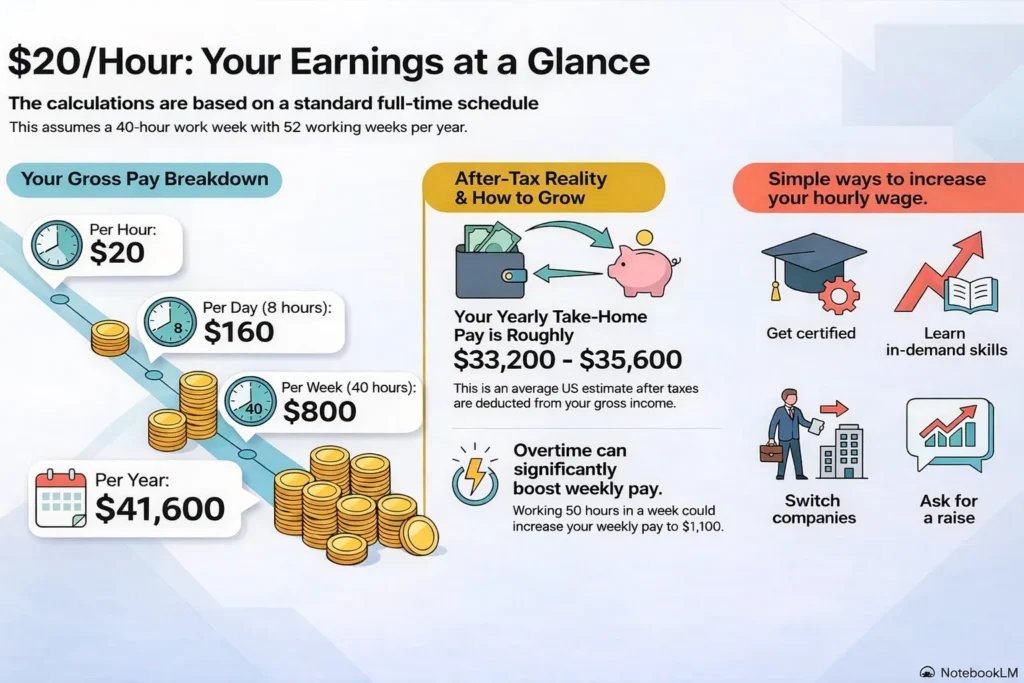

Weekly Income at $94 an Hour

A standard 40-hour workweek produces a weekly gross income of $3,760 before taxes. This amount does not yet account for federal, state, or payroll deductions. If you work overtime, each extra hour is typically paid at 1.5×, which equals $141 per overtime hour, rapidly increasing weekly earnings.

Biweekly Pay at $94 an Hour

Most U.S. employers pay workers every two weeks. At $94/hour, your biweekly paycheck equals $7,520 before taxes. This is the number most households use for managing rent or mortgage payments, major bills, and structured budgeting.

Monthly Income at $94 an Hour

Monthly income is calculated by spreading annual earnings across 12 months. With a yearly salary of $195,520, your estimated monthly income equals about $16,293 before taxes. This level of income allows for premium housing, comprehensive insurance, high-level investing, and a very comfortable lifestyle in most regions.

$93 an Hour Is How Much a Year

When calculated using the standard full-time formula:

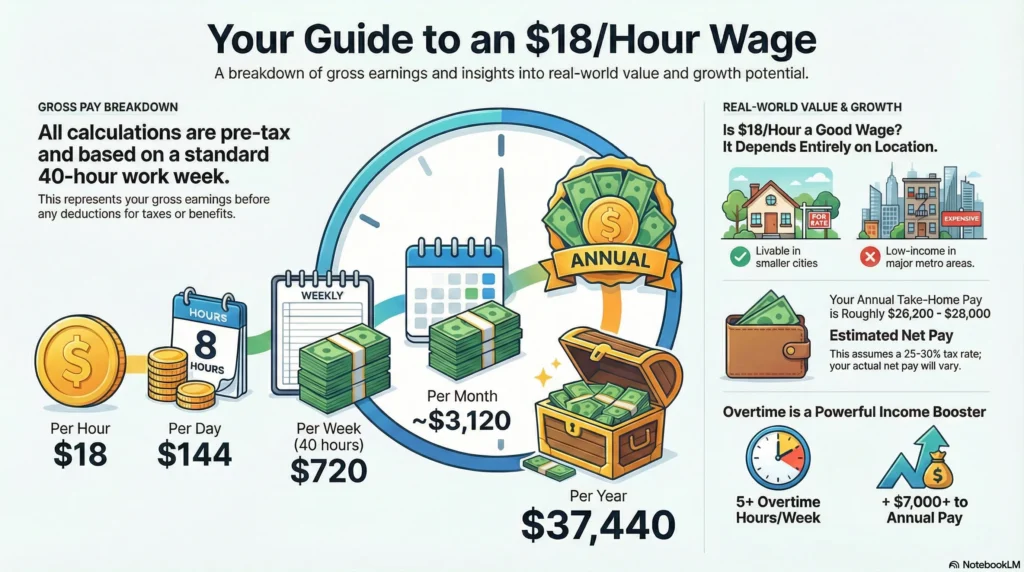

$94 × 40 × 52 = $195,520 per year (before taxes)

This places your income well into the top income tier nationwide and far above both the national median individual and household income.

Is $195,000 a Year Considered Wealthy?

In most U.S. states, an income near $200,000 per year provides strong wealth-building power when managed well. It supports long-term asset accumulation, early financial independence, and sustained multi-generational financial security.

Final Verdict: Is $94 an Hour Worth It?

Earning $94 an hour equals $195,520 per year before taxes and approximately $129,000–$137,000 after taxes. This income level enables elite living standards, rapid investment growth, real estate ownership, and accelerated wealth creation. From every financial perspective, $94/hour represents top-tier earning power in today’s U.S. economy.

FAQ – $94 an Hour Is How Much a Year

Hey there! I’m Kumar, the owner of DollarHire. Alongside working as an Executive SEO Specialist, I studied at a finance institute to strengthen my skills in finance and marketing.

Pingback: $95 an Hour Is How Much a Year, Daily, Weekly, Monthly -2025

Pingback: $97 an Hour Is How Much a Year, Daily, Weekly, Monthly -2025

Pingback: $96 an Hour Is How Much a Year? This Will Shock You! 😱