$28/Hour Income at a Glance

💰 After-tax: $42,500-$45,500 annually estimated

Earning 28 an hour positions you in a competitive wage bracket with solid middle-income earning potential across most American markets. This hourly rate provides financial stability for covering necessities while leaving room for savings and lifestyle choices. Understanding how $27/hour compares to $28/hour reveals a $2,080 annual difference, while stepping up to $29/hour adds another $2,080 to your yearly income.

28 an hour is how much a year?

At 28 per hour working full-time, your annual salary is $58,240.

The standard calculation uses 2,080 working hours per year (40 hours per week × 52 weeks).

So, $28 × 2,080 hours = $58,240 per year before taxes.

How much is $28 an hour per month?

Working full-time at $28/hour gives you a monthly income of approximately $4,853.33.

You can calculate this two ways: divide annual salary by 12 months ($58,240 ÷ 12), or multiply weekly pay by average weeks per month ($1,120 × 4.33).

Both methods yield roughly $4,853 per month before taxes, which is the key number for budgeting rent, utilities, and monthly expenses.

How much is $28 an hour bi-weekly?

For bi-weekly pay periods, earning $28/hour results in $2,240 per paycheck.

This calculation is simple: 40 hours per week × 2 weeks = 80 hours, then 80 hours × $28 = $2,240 bi-weekly.

Bi-weekly pay is one of the most common payroll systems in the USA, with 26 pay periods annually.

How much is $28 an hour weekly?

Working 40 hours per week at $28/hour gives you $1,120 weekly.

Simply multiply your hourly wage by weekly hours: $28 × 40 = $1,120 per week before taxes.

If you work overtime hours at time-and-a-half ($42/hour), your weekly earnings can increase substantially.

$28 an hour is how much a day?

Based on a standard 8-hour workday, your daily income at $28/hour is $224.

The calculation: $28 × 8 hours = $224 per day before taxes.

For longer shifts like 10 or 12 hours, your daily earnings scale accordingly to $280 or $336 respectively.

Full Income Summary: $28/Hour

| Pay Period | Gross Pay | Net Pay (Est.)* |

|---|---|---|

| Hourly | $28.00 | $21.00 – $22.40 |

| Daily (8 hours) | $224 | $168 – $179 |

| Weekly (40 hours) | $1,120 | $840 – $896 |

| Bi-Weekly | $2,240 | $1,680 – $1,792 |

| Monthly | $4,853.33 | $3,640 – $3,883 |

| Annually | $58,240 | $43,680 – $46,592 |

*Net pay estimates based on 20-25% effective tax rate (federal, FICA, state combined).

State-by-State Take-Home at $28/Hour

Your actual purchasing power varies significantly based on state taxation:

🌟 Best Net Income States

📉 Higher Tax States

💡 Tax Impact: The $3,600 annual difference between Oregon and Washington equals $300 monthly—enough for a solid car insurance premium or substantial grocery budget.

Living on $28/Hour Across America

National Earning Context

Your $58,240 annual salary represents 82% of the U.S. median household income ($70,784). This places you solidly in the middle-income range with stable earning power for building financial security.

Jumping from $27/hour ($56,160) to $28/hour adds $2,080 annually—$173 extra monthly for savings or debt reduction.

✓ Comfortable Markets

- Most Southern and Midwest cities

- Suburban areas nationwide

- Smaller metros under 500K

- College towns with affordable housing

⚡ Budget-Conscious Areas

- San Francisco, NYC, Boston metros

- Southern California coast

- Seattle, Denver centers

- High-demand housing markets

Practical Budget on $28/Hour

Based on ~$3,750 monthly after-tax income (moderate state):

Essentials: $1,875 (50%)

Core living costsDiscretionary: $1,125 (30%)

Quality of lifeSavings: $750 (20%)

Future securityBoost Your $28/Hour Income

Leverage Overtime

At $42/hour (1.5x rate), overtime boosts income significantly:

- 5 OT hours weekly = $10,920 extra/year

- 10 OT hours weekly = $21,840 extra/year

Quick Certifications

Credentials boosting to $32-$38/hour:

- PMP Basics: $28 → $35/hr

- Advanced Excel/SQL: $28 → $32/hr

- Scrum Master: $28 → $36/hr

Company Switch

External moves yield bigger raises:

- $28 → $31/hr = $6,240 annual boost

- $28 → $34/hr = $12,480 annual boost

Typical Jobs at $28/Hour

This wage level spans diverse professional roles:

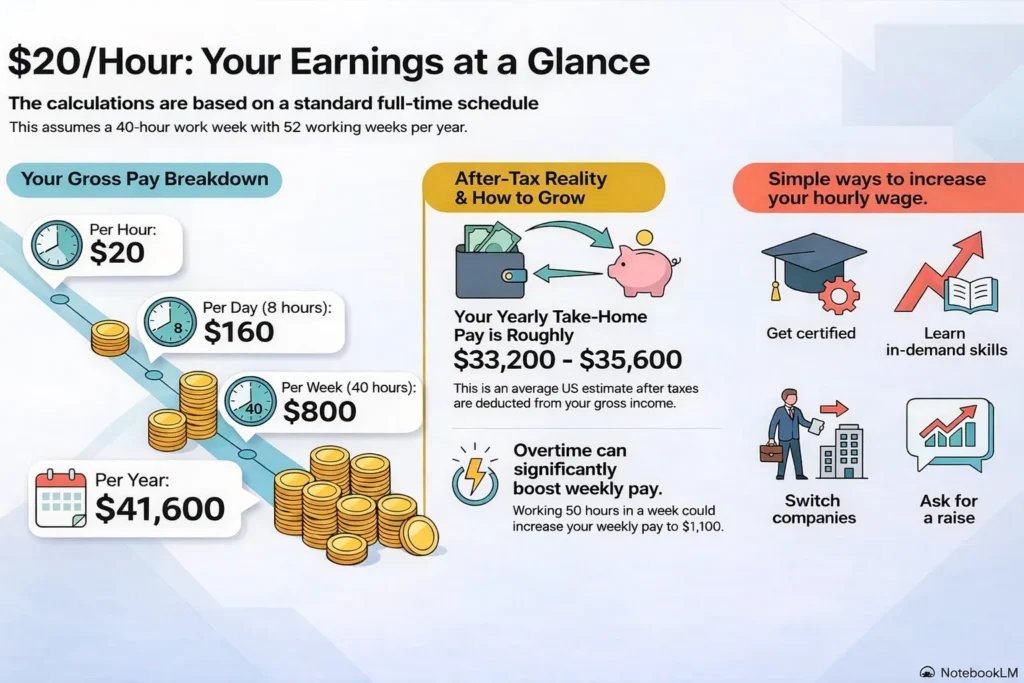

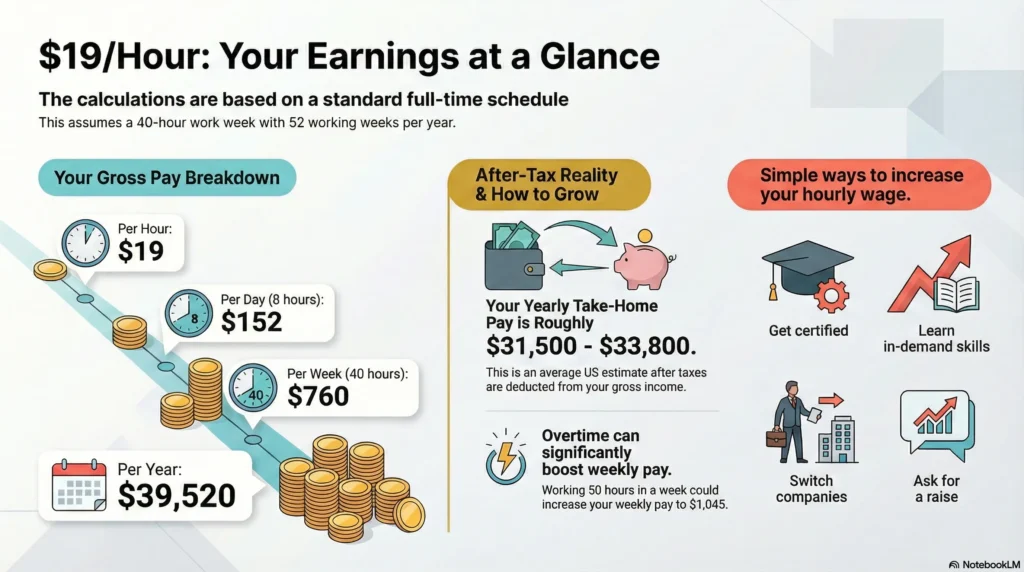

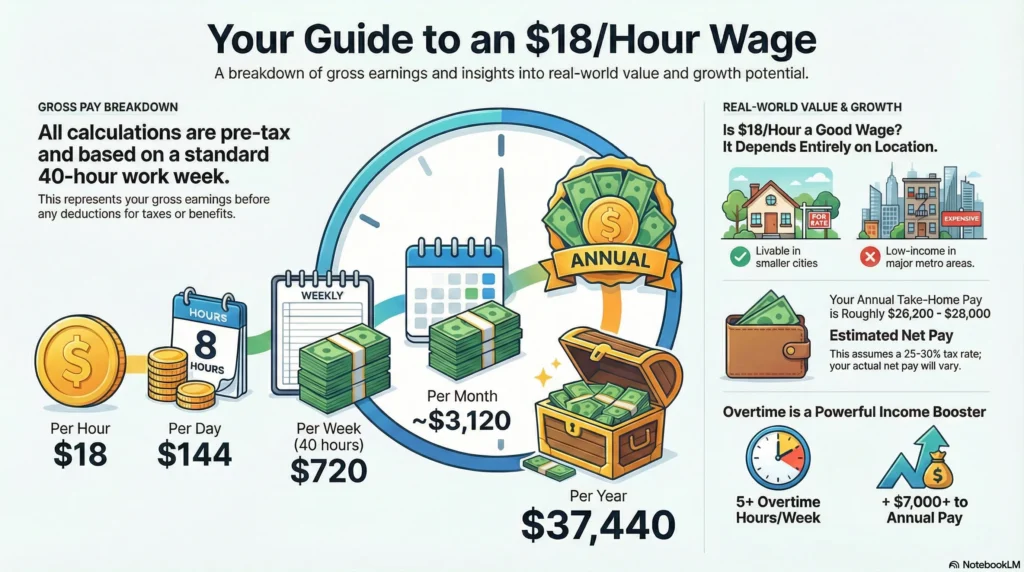

Compare Similar Wages

See the impact of wage variations:

Frequently Asked Questions

Is $28 an hour good pay?

Yes, $28/hour is solid pay across most U.S. markets. It equals $58,240 annually and places you in the middle-income bracket with comfortable living potential in moderate-cost areas.

How much is $28/hour with 10 hours weekly overtime?

Regular 40 hours ($1,120) plus 10 overtime hours at $42/hour ($420) totals $1,540 weekly. Annually, this equals $80,080—a $21,840 increase from base pay.

Can you support a family on $28 an hour?

Yes, in low-to-moderate cost markets. A $58,240 household income supports a family of 3-4 with careful budgeting in most regions. Expensive metros may require dual incomes.

How much is $28/hour part-time (25 hours)?

Working 25 hours weekly at $28/hour equals $700 per week or $36,400 annually before taxes. This nets approximately $560-$595 weekly after deductions.

What’s $28/hour after California taxes?

In California, earning $28/hour ($58,240 annually) leaves roughly $44,400 net pay after federal, FICA, and state taxes. This equals about $3,700 monthly or $1,708 bi-weekly.

Career Advancement Story

Nicole started as a dental hygienist at $28/hour. After obtaining her bachelor’s degree in dental hygiene while working full-time, she negotiated a raise to $34/hour. The $12,480 annual increase allowed her to pay off student loans two years early and start investing in a retirement account, setting her up for long-term financial security.

Hey there! I’m Kumar, the owner of DollarHire. Alongside working as an Executive SEO Specialist, I studied at a finance institute to strengthen my skills in finance and marketing.

Pingback: $29 an Hour Is How Much a Year In 2025?

Pingback: $31 an Hour Is How Much a Year ? (Net vs Gross Pay)

Pingback: $30 an Hour Is How Much a Year ? This Will Shock You! 😱