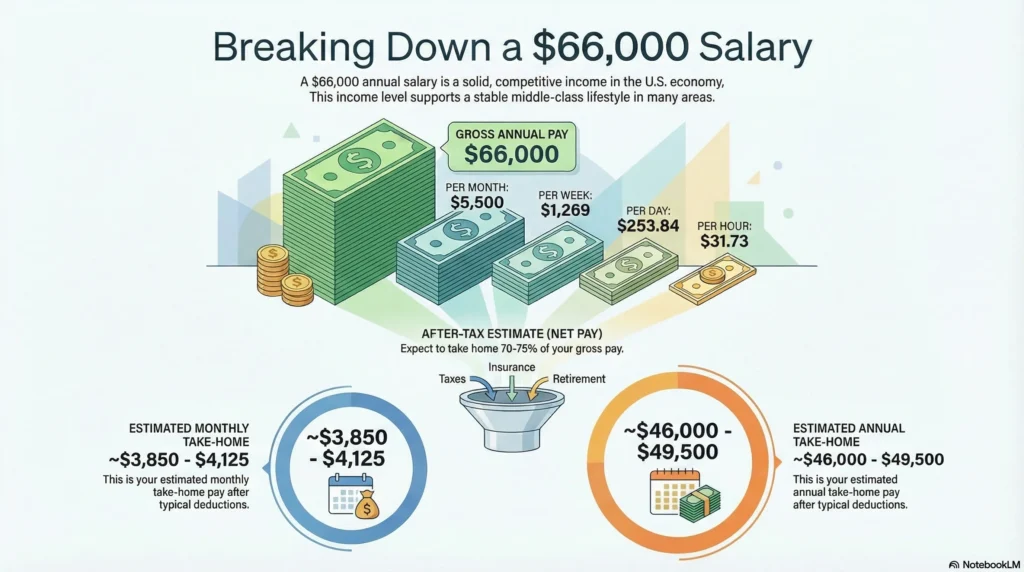

If you earn $66,000 a year, your hourly wage comes out to about $31.73 per hour, assuming a standard full-time schedule of 40 hours per week and 52 weeks per year. This income level places you comfortably above the U.S. median individual income and offers a stable middle-class lifestyle in many parts of the country.

Below, I’ll break this salary down into hourly, daily, weekly, biweekly, and monthly pay, and explain what $66,000 a year realistically means for your finances.

Salary Calculator

Salary Conversion

Read More:

$65,000 a Year Is How Much an Hour?

$63,000 a Year Is How Much an Hour?

$64,000 a Year Is How Much an Hour?

How Much Is $66,000 a Year Per Hour?

Most full-time jobs in the U.S. are based on 2,080 working hours per year (40 hours × 52 weeks).

Calculation:

$66,000 ÷ 2,080 = $31.73 per hour

So if you’re earning $66,000 annually, you’re making just under $32 an hour before taxes.

Daily Income on a $66,000 Salary

A typical full-time workday is 8 hours.

At $31.73 per hour:

$31.73 × 8 = $253.84 per day (before taxes)

This daily figure helps put your earnings into perspective—especially when budgeting for groceries, transportation, or daily expenses.

Weekly Pay at $66,000 a Year

A full-time workweek is 40 hours.

$31.73 × 40 = $1,269 per week (before taxes)

If your job offers overtime, your weekly income can increase quickly, since overtime is often paid at 1.5× your hourly rate.

Biweekly Pay for a $66,000 Salary

Many U.S. employees are paid every two weeks.

$1,269 × 2 = $2,538 biweekly (before taxes)

This is the number most people use for rent, mortgage payments, and recurring bills.

Monthly Income on $66,000 a Year

There are two common ways to calculate monthly income. The simplest method is dividing your annual salary by 12.

$66,000 ÷ 12 = $5,500 per month (before taxes)

This level of monthly income allows for comfortable budgeting in many mid-cost areas, especially if debt is limited.

Yearly Salary Summary for $66,000

Using the full formula:

$31.73 × 40 × 52 = $66,000 per year (before taxes)

This confirms your total gross annual income.

What Does $66,000 a Year Mean After Taxes?

Your take-home pay depends on:

- State taxes

- Filing status

- Health insurance

- Retirement contributions

On average, many workers keep 70%–75% of their gross income.

Estimated take-home pay:

- Monthly: ~$3,850 – $4,125

- Yearly: ~$46,000 – $49,500

Final Thoughts: Is $66,000 a Year Worth It?

Earning $66,000 a year, or about $31.73 an hour, provides dependable financial stability for many U.S. workers. While it may not feel luxurious everywhere, it offers a strong balance between income, lifestyle, and long-term financial growth—especially when paired with raises, promotions, or additional skills.

If you’re evaluating a job offer, planning a career move, or budgeting your income, $66,000 is a solid and competitive salary in today’s economy.

Hey there! I’m Kumar, the owner of DollarHire. Alongside working as an Executive SEO Specialist, I studied at a finance institute to strengthen my skills in finance and marketing.