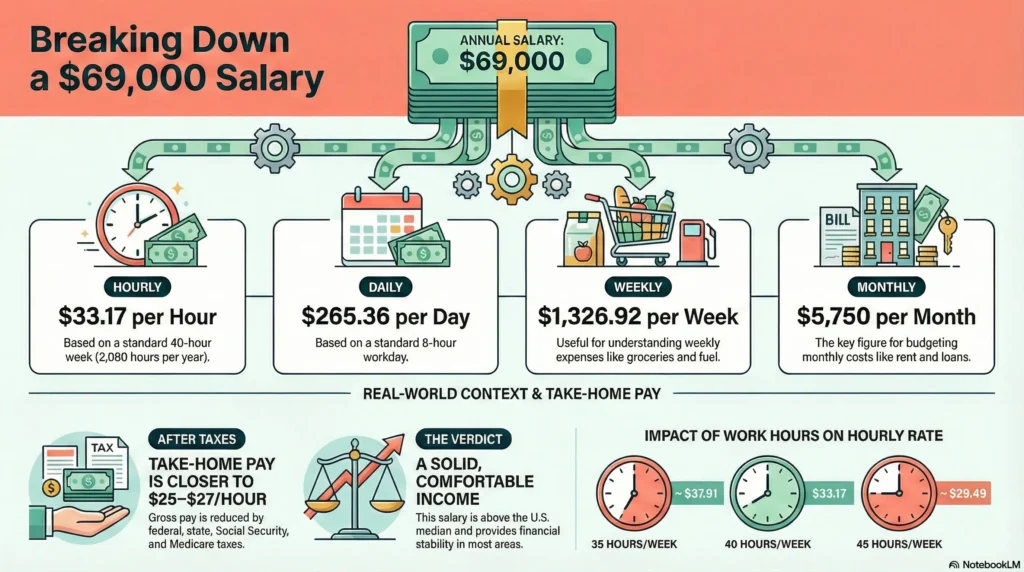

When I came across a salary of $69,000 per year, my first thought was the same as always: what does that actually mean per hour? Annual salaries can sound impressive, but I’ve learned that breaking them down into hourly, weekly, and monthly pay gives a much clearer picture of what life on that income really looks like.

$69,000 a Year Equals $33.17 an Hour

Here’s the simple math I used, based on a standard full-time schedule in the U.S.:

- 40 hours per week × 52 weeks = 2,080 hours per year

- $69,000 ÷ 2,080 = $33.17 per hour

So, if you work full time, $69,000 a year works out to about $33.17 an hour before taxes.

Salary Calculator

Salary Conversion

Read More:

How I Break Down $69,000 by Pay Period

Seeing the hourly rate was helpful, but what really mattered to me was how this salary shows up in everyday pay periods.

Daily Pay (8-Hour Workday)

- $33.17 × 8 = $265.36 per day

That means each normal workday is worth around $265 before taxes.

Weekly Pay

- $69,000 ÷ 52 = $1,326.92 per week

This weekly number helped me visualize ongoing expenses like groceries, fuel, and small savings.

Bi-Weekly Pay

- $69,000 ÷ 26 = $2,653.85 every two weeks

This is the figure most people see on a bi-weekly paycheck, before deductions.

Monthly Pay

- $69,000 ÷ 12 = $5,750 per month

For me, monthly income matters most because rent, loans, and subscriptions are all paid monthly.

What $69,000 a Year Feels Like in Real Life

From my perspective, $69,000 a year is a solid, comfortable income in many parts of the United States. It’s not luxury money, but it does provide financial stability and room to breathe if expenses are managed wisely.

What stood out to me:

- It’s well above most hourly jobs under $25 an hour

- It allows consistent saving with controlled spending

- It feels like a meaningful step up from salaries in the low-$60k range

In lower-cost states, this salary can feel very comfortable. In high-cost cities, it’s still livable but requires tighter budgeting.

How Taxes Change the Real Hourly Pay

One thing I always remind myself: $33.17 an hour is gross pay, not what I actually take home.

After:

- Federal income tax

- State tax (if applicable)

- Social Security and Medicare

My take-home pay would likely fall closer to $25–$27 an hour, depending on location and deductions.

That’s why I focus more on net monthly income than the headline salary.

Is $69,000 a Year a Good Salary?

In my opinion, yes—$69,000 a year is a good salary if:

- You live in a moderate-cost area

- You’re single or in a dual-income household

- You manage debt and expenses carefully

Compared to the U.S. median individual income, $69,000 is above average and provides solid financial stability.

Hourly Pay at Different Work Schedules

Not everyone works exactly 40 hours per week. Here’s how the hourly rate changes:

- 35 hours/week: ~$37.91 per hour

- 40 hours/week: $33.17 per hour

- 45 hours/week: ~$29.49 per hour

This really highlighted for me how unpaid overtime can reduce the real value of a salary.

Final Thoughts: My Honest Take on $69,000 a Year

When I break it down clearly, $69,000 a year equals about $33.17 an hour, and that’s a strong income in today’s market. What matters most isn’t just the number, but:

- Where you live

- How many hours you work

- How much you actually take home after taxes

Once I viewed this salary in daily, weekly, and monthly terms, it became much easier for me to decide whether it truly fit my lifestyle and financial goals.

Hey there! I’m Kumar, the owner of DollarHire. Alongside working as an Executive SEO Specialist, I studied at a finance institute to strengthen my skills in finance and marketing.

Pingback: $70,000 a Year Is How Much an Hour? This Will Shock You! 😱

Pingback: $71,000 a Year Is How Much an Hour? (2026 Salary Breakdown)

Pingback: $72,000 a Year is How Much an Hour? | 2026 Salary Calculator