How much is $72,000 a year hourly?

If you’re earning $72,000 annually, your hourly wage is approximately $34.62.

To calculate this, divide your yearly salary by the average number of working hours per year — typically 2,080 hours (52 weeks × 40 hours).

So, $72,000 divided by 2,080 equals an hourly income of $34.62.

How much is $72,000 a year daily?

With an annual income of $72,000, your daily earnings amount to about $276.92.

Simply divide your yearly salary by the number of working days in a year, generally 260 (52 weeks × 5 workdays).

So, $72,000 divided by 260 equals a daily income of $276.92.

How much is $72,000 a year weekly?

If you make $72,000 per year, your weekly salary comes out to around $1,384.62.

Simply divide your annual income by 52 weeks. So, $72,000 divided by 52 equals a weekly income of $1,384.62.

How much is $72,000 a year bi-weekly?

Earning $72,000 a year gives you a bi-weekly income of approximately $2,769.23.

To calculate this, divide your yearly salary by 26, the number of bi-weekly pay periods in a year.

So, $72,000 divided by 26 equals a bi-weekly income of $2,769.23.

How much is $72,000 a year monthly?

If your annual salary is $72,000, your monthly income is $6,000.

Simply divide your yearly income by 12 months.

So, $72,000 divided by 12 equals a monthly income of $6,000.

Quick Reference Summary

| Time Period | Gross Income |

|---|---|

| Hourly | $34.62 |

| Daily | $276.92 |

| Weekly | $1,384.62 |

| Bi-Weekly | $2,769.23 |

| Monthly | $6,000 |

| Yearly | $72,000 |

Understanding Your Take-Home Pay

The figures above represent your gross income before taxes and deductions. Your actual take-home pay will be lower after accounting for various withholdings.

Federal Tax Withholdings

For a single filer earning $72,000 in 2026, your estimated federal tax liability is approximately $10,200, leaving you with about $61,800 after federal taxes. This assumes the standard deduction and no additional credits.

- Monthly: $5,150 (vs. $6,000 gross)

- Bi-Weekly: $2,376.92 (vs. $2,769.23 gross)

- Weekly: $1,188.46 (vs. $1,384.62 gross)

FICA Taxes (Social Security & Medicare)

In addition to federal income tax, you’ll pay 7.65% in FICA taxes ($5,508 annually), which covers Social Security (6.2%) and Medicare (1.45%).

Additional Deductions

Your paycheck may also include deductions for:

- State and local income taxes (varies by location)

- Health insurance premiums

- 401(k) or retirement contributions

- HSA or FSA contributions

- Disability insurance

$72,000 After Taxes by State

Your take-home pay varies significantly depending on your state of residence. Here’s what you can expect to take home annually in different states:

Note: These are approximate figures for single filers taking the standard deduction. Actual amounts vary based on filing status, deductions, and local taxes.

Is $72,000 a Good Salary?

How $72,000 Compares Nationally

A $72,000 annual salary places you above the median household income in the United States, which was approximately $70,784 in 2024.

You’re earning approximately 2% more than the median American household, positioning you in the middle to upper-middle income bracket.

Comparing salaries can help contextualize your earnings. For instance, if you’re considering a position that pays $70,000 a year versus $72,000, that’s a difference of about $0.96 per hour.

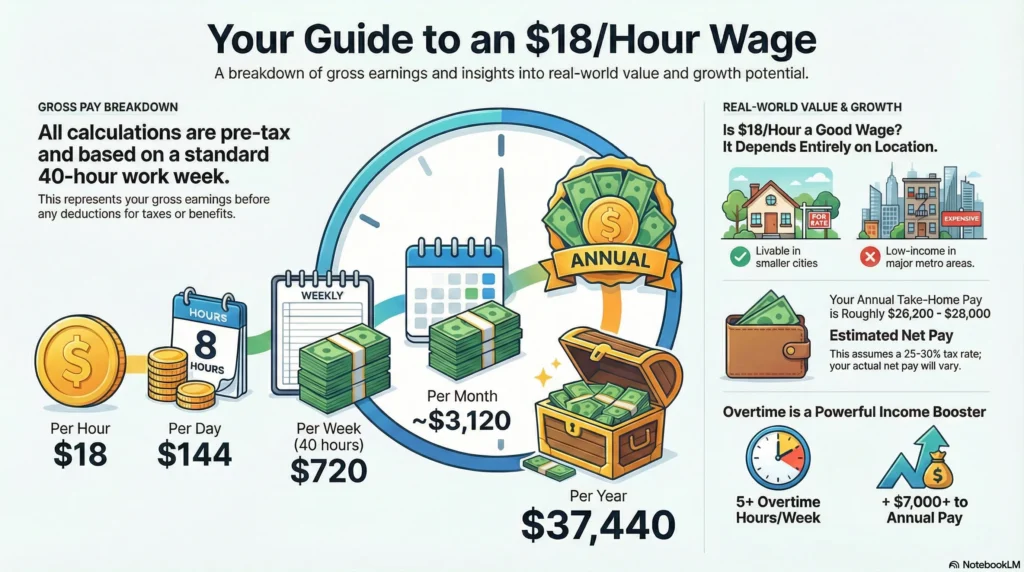

Geographic Considerations

Whether $72,000 is a comfortable salary depends heavily on your location:

- High Cost of Living Areas: In cities like San Francisco, New York, or Boston, $72,000 may feel tight, especially for families.

- Medium Cost of Living Areas: In cities like Austin, Denver, or Atlanta, $72,000 provides a comfortable lifestyle for singles and couples.

- Low Cost of Living Areas: In smaller cities and rural areas, $72,000 can provide a very comfortable lifestyle with room for savings.

Sample Monthly Budget on $72,000

Here’s a practical budget example for someone earning $72,000 annually, using the 50/30/20 rule (based on after-tax monthly income of approximately $5,150):

Needs (50% = $2,575)

Wants (30% = $1,545)

Savings & Debt (20% = $1,030)

This budget assumes you’re maximizing your take-home pay. Adjust based on your actual tax situation, location, and personal priorities.

Retirement Planning on $72,000

Recommended Retirement Savings

Financial experts recommend saving 15-20% of your gross income for retirement. On a $72,000 salary, that’s $10,800 to $14,400 annually, or $900 to $1,200 monthly.

Employer 401(k) Match Example

If your employer offers a 50% match on the first 6% of contributions:

- Your 6% contribution: $4,320/year ($360/month)

- Employer match: $2,160/year ($180/month)

- Total retirement savings: $6,480/year ($540/month)

Long-Term Projection

If you save $1,000/month starting at age 30:

- By age 65 (35 years), assuming 7% annual returns: ~$1,660,000

- Your contributions: $420,000

- Investment growth: $1,240,000

Careers That Pay $72,000

Many professions offer salaries around $72,000. Here are some common examples:

- Registered Nurses: Average $72,000-$77,000

- Software Developers (Entry-Level): $65,000-$80,000

- Marketing Managers: $68,000-$85,000

- Accountants: $65,000-$75,000

- Financial Analysts: $70,000-$80,000

- Project Managers: $70,000-$90,000

- Human Resources Specialists: $65,000-$75,000

- Teachers (with experience): $60,000-$75,000

Salaries in these fields vary based on experience, location, education, and company size.

Maximizing Your $72,000 Salary

Tax Optimization Strategies

- Contribute to a traditional 401(k) to reduce taxable income

- Maximize HSA contributions ($4,300 individual limit in 2026)

- Take advantage of pre-tax benefits like commuter benefits

- Claim all eligible tax credits and deductions

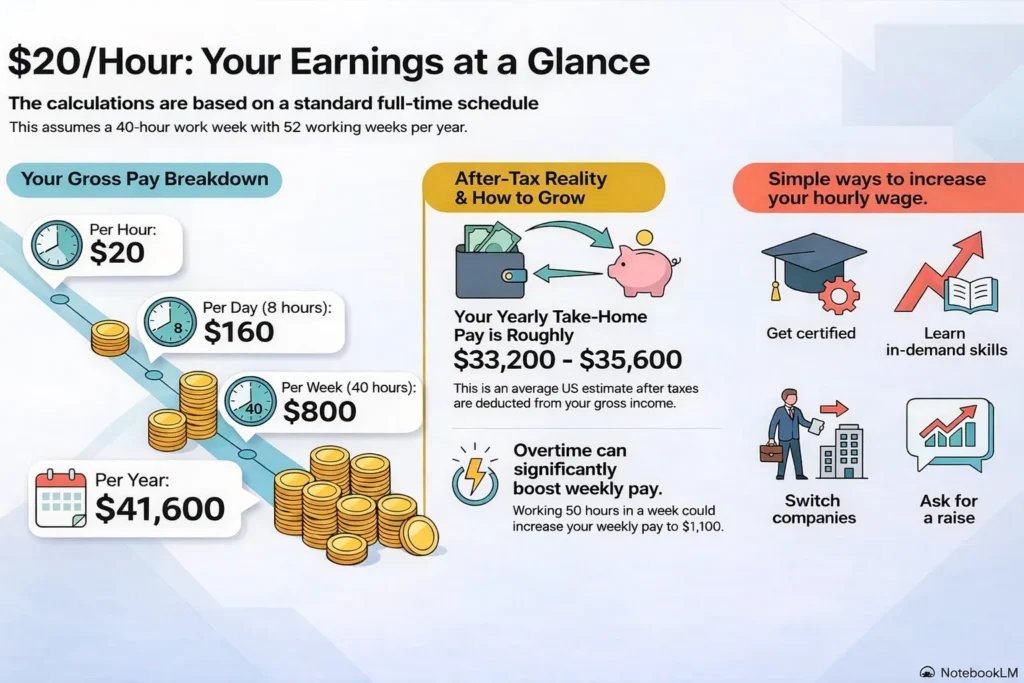

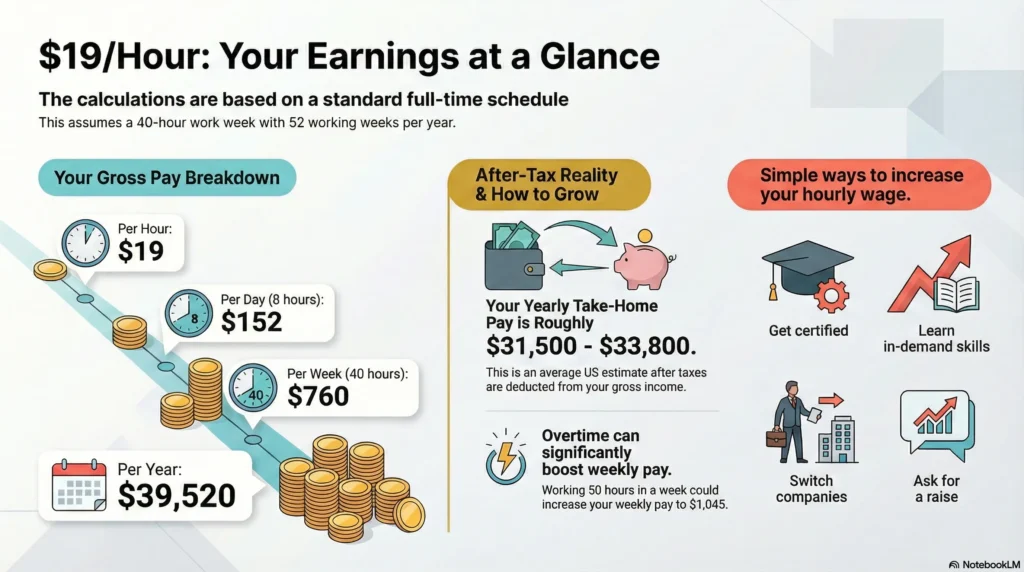

Increase Your Take-Home Pay

- Negotiate: Ask for a raise or better benefits package. Even a modest increase from $71,000 to $72,000 adds $1,000 annually.

- Side Income: Freelancing or consulting can add $500-$2,000+ monthly

- Skills Development: Certifications can lead to 10-20% salary increases

- Remote Work: Moving to a lower cost-of-living area while keeping your salary

Related Salary Calculators

Exploring different salary ranges? Check out these related calculators:

- $71,000 a Year is How Much an Hour? – Just $1,000 less than $72k

- $70,000 a Year is How Much an Hour? – Compare to a $70k salary

- $69,000 a Year is How Much an Hour? – See the breakdown for $69k

Understanding salary comparisons helps you evaluate job offers and negotiate better compensation packages.

Frequently Asked Questions

How much is $72,000 a year after taxes?

After federal taxes, FICA, and state taxes (if applicable), you can expect to take home between $54,500 and $58,300 annually, depending on your state. This translates to roughly $4,540 to $4,858 per month.

Is $72,000 a year a good salary for a single person?

Yes, $72,000 is generally considered a good salary for a single person in most parts of the United States. It’s above the median household income and allows for comfortable living, savings, and discretionary spending in most areas.

Can you buy a house on a $72,000 salary?

Yes, with a $72,000 salary, you can typically qualify for a home loan of approximately $250,000-$300,000, depending on your debt-to-income ratio, credit score, and down payment. This is comfortable in many markets but may be challenging in high-cost cities. If you’re comparing offers, note that someone earning $69,000 a year would qualify for slightly less, while a $71,000 salary would be nearly equivalent.

How much is $72,000 a year per paycheck?

If you’re paid bi-weekly (26 pay periods), your gross paycheck is $2,769.23. After taxes and deductions, expect approximately $2,100-$2,400 per paycheck depending on your state and withholdings.

What is $72,000 a year after taxes in California?

In California, a $72,000 salary results in approximately $55,200 take-home pay after federal taxes, FICA, and state income tax. This equals about $4,600 per month or $2,123 bi-weekly.

Hey there! I’m Kumar, the owner of DollarHire. Alongside working as an Executive SEO Specialist, I studied at a finance institute to strengthen my skills in finance and marketing.

Pingback: $73,000 a Year is How Much an Hour? | 2026 Salary Calculator